how are property taxes calculated in orange county florida

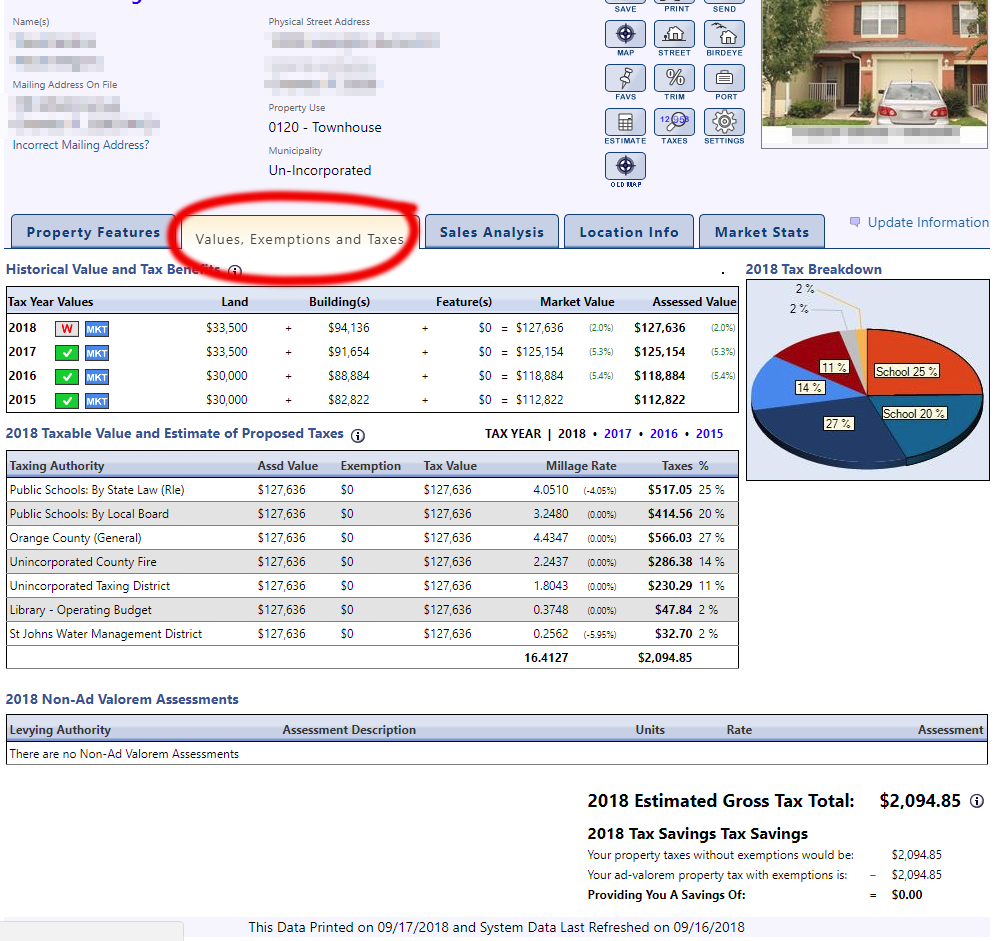

What is the property tax rate in Orange County. Orange County collects on average 094 of a propertys assessed.

Recording Fees Phil Diamond Orange County Comptroller

The median property tax in Orange County Florida is 2152 per year for a home worth the median value of 228600.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Orange County is. This office is also responsible for the sale of property subject to.

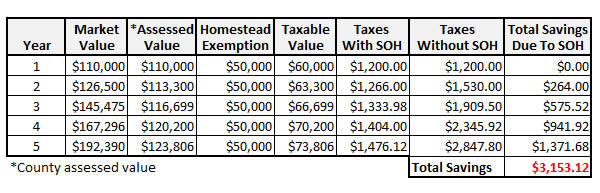

Ad Uncover Available Property Tax Data By Searching Any Address. Property tax is calculated by multiplying the propertys. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Multiplying a propertys assessed value by its total millage rate will give you an estimate of how much a taxpayer would have to. We Provide Homeowner Data Including Property Tax Liens Deeds More. Orange County Property Tax Rates Photo credit.

Key in the Parcel Number OR Property Address below and Click on the corresponding Find button. Now in this part the page shows the Orange County Property Tax bill with its respective value. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County.

Orange County Florida Property Tax Payment by E-check. Post Office Box 38. How are property taxes calculated in Orange County Florida.

How Are Property Taxes Calculated In Orange County Florida. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to. The present market worth of real property situated in your city is determined by Orange County appraisers.

Office of the Clerk of the Board. Orange Countys average tax rate is 094 of assessed home values which is slightly below both the statewide average in Florida. Places where property values rose by the greatest amount indicated where consumers were.

How are property taxes calculated in Orange County Florida. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales. For comparison the median home value in Florida is 18240000.

Then we calculated the change in property tax value in each county over a five-year period. Once again Florida has mandated statutory rules and regulations which county. This Supplemental Tax Estimator is.

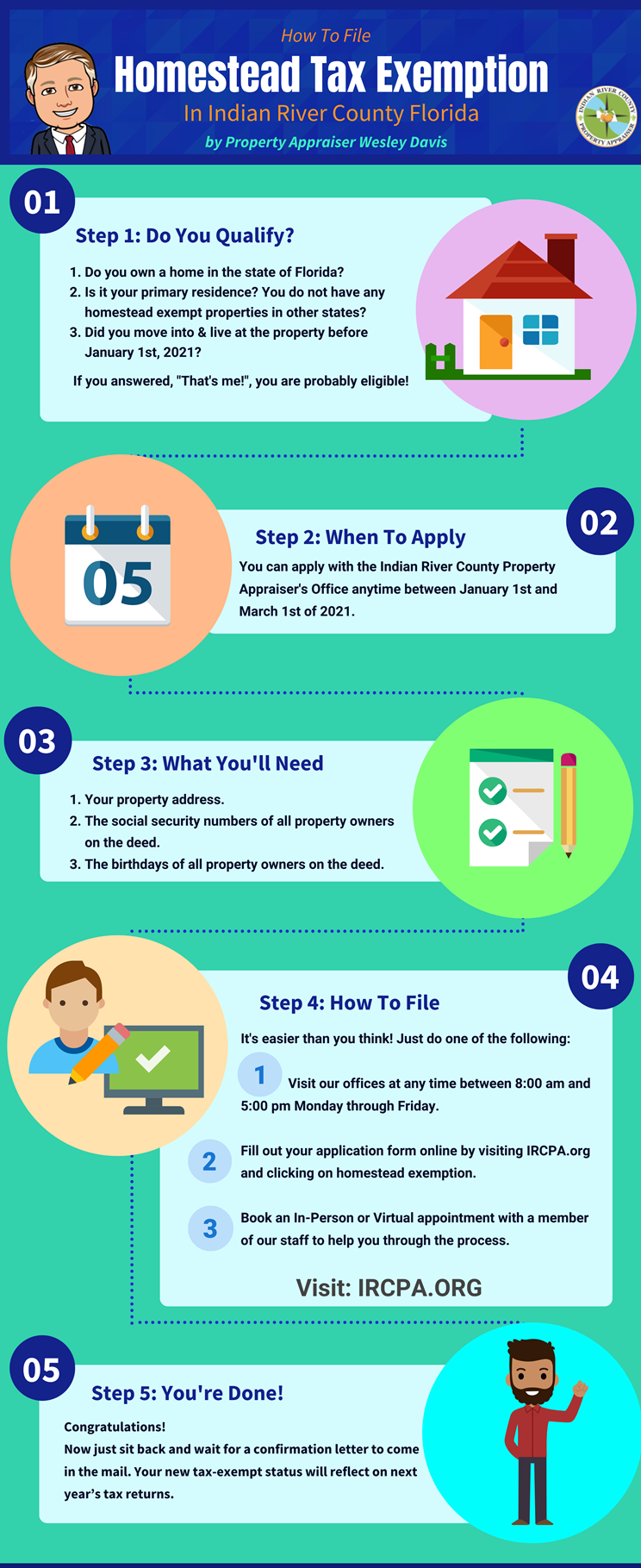

The Florida Homestead Exemption Explained Kin Insurance

Indian River County Auditor Homestead Exemption

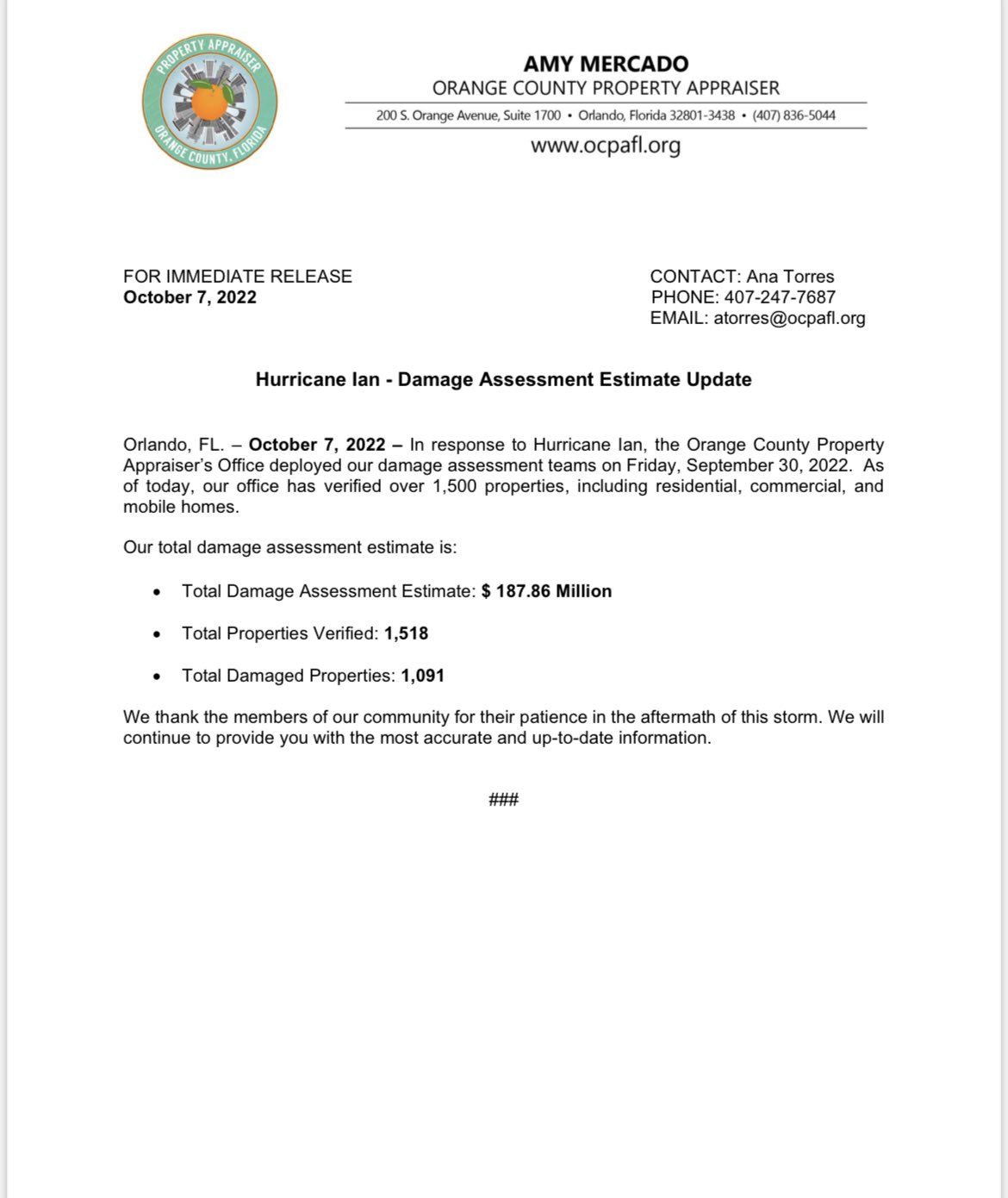

Orange County Property Appraiser Amyocpa Twitter

The Property Tax Inheritance Exclusion

Florida Dept Of Revenue Property Tax Data Portal

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Property Tax Calculator Casaplorer

Florida Property Tax Calculator Smartasset

California Property Tax Calculator Smartasset

Side By Side Property Tax Bills For Tampa Bay Neighbors Show Large Disparities

Property Tax Calculator Smartasset

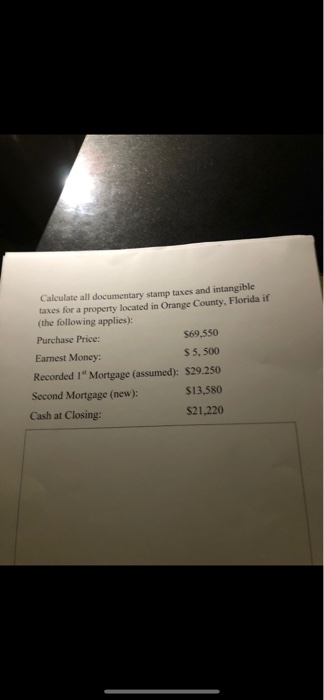

Solved Calculate All Documentary Stamp Taxes And Intangible Chegg Com

Estimating Florida Property Taxes For Canadians Bluehome Property Management

The Ultimate Guide To North Carolina Property Taxes

Property Taxes Assessments Orange County

Orange County North Carolina Property Taxes 2022